*Discover the investment opportunity that addresses two massive markets simultaneously—and why Cydonis is uniquely positioned to capture both!*

The global energy transformation represents one of history’s largest investment opportunities. Whilst renewable energy sources continue their exponential growth, savvy investors are recognising a critical gap in the market: the world desperately needs both reliable, base-load clean energy *and* scalable solutions for existing atmospheric carbon.

Most companies are chasing one piece of this puzzle. At Cydonis Heavy Industries, we’ve cracked the code on both—simultaneously. This isn’t just about building another clean energy company; it’s about capturing value from the convergence of two multi-trillion-pound markets that are only beginning to realise their full potential.

The Investment Thesis: Why Fusion-Plus Wins

Here’s what sets institutional investors apart from the crowd—they recognise paradigm shifts before they become obvious. Our breakthrough represents exactly that: a paradigm shift in how the market thinks about clean energy investments.

Whilst the fusion sector has made remarkable progress, with well-funded companies like Commonwealth Fusion Systems and Helion Energy targeting breakthrough milestones by 2025-2026, every single one is competing in the same space: pure energy generation. That’s a massive market, but it’s also increasingly crowded.

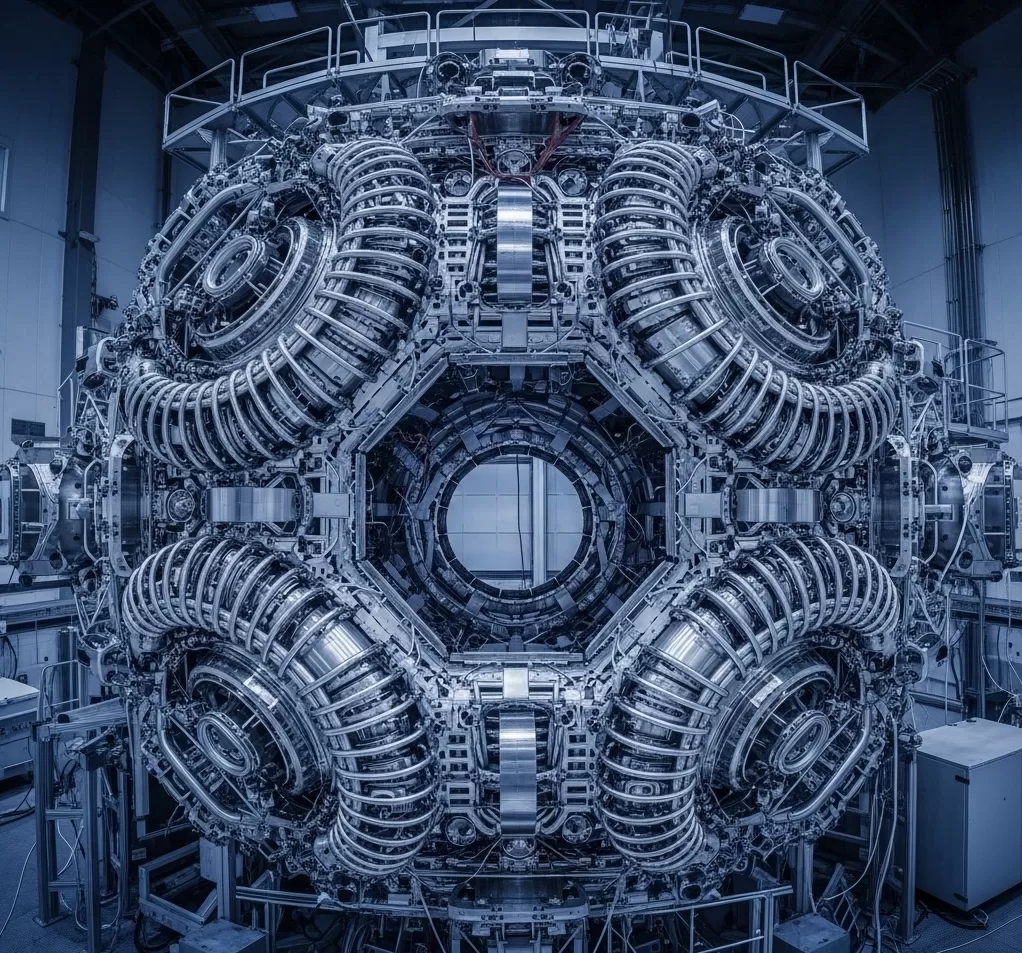

Cydonis has developed something the market hasn’t seen: a novel fusion reactor design that integrates our proprietary “dequestration” technology. This isn’t incrementally better—it’s categorically different.

What is dequestration?

Think beyond traditional carbon sequestration. Whilst others capture and store CO₂, our dequestration process actively transforms carbon compounds into valuable by-products or integrates them directly into the fusion cycle itself. We’re not just managing carbon—we’re monetising it.

This creates what investors love most: multiple revenue streams from a single technology platform.

The Market Opportunity: Two Megatrends, One Platform

Smart capital follows market size and timing. Here’s why both are working in our favour:

The Energy Revolution** (£Multi-Trillion Market)

Our fusion reactor delivers everything institutional energy buyers are demanding:

– Zero CO₂ emissions with 24/7 reliability (unlike intermittent renewables)

– No long-lived radioactive waste (cleaner than fission)

– Unlimited fuel supply (deuterium from seawater, lithium from abundant reserves)

– Inherent safety profile (no meltdown risk—physics makes it impossible)

– Industrial-scale, base-load power for hard-to-decarbonise sectors

The Carbon Economy (Explosive Growth Market)

The dequestration component unlocks entirely new value streams:

– Transforms industrial carbon waste into revenue-generating by-products

– Processes atmospheric CO₂ into valuable materials

– Creates closed-loop carbon management solutions

– Generates premium carbon credits through active carbon transformation

This dual value proposition means we’re not just competing for energy market share—we’re creating an entirely new market category. First-mover advantage in a category you define? That’s how generational wealth gets built.

Strategic Market Positioning

The timing couldn’t be better. With over £5.5 billion in private investment flowing into fusion globally, and the carbon management sector expanding rapidly, we sit at the convergence of two massive market opportunities. Companies across industries are recognising that future energy infrastructure must address both power generation and carbon footprint management.

Major players like Shell and Mitsubishi are already investing heavily in carbon capture and storage projects, while energy companies are seeking integrated solutions. Net Power Inc., for example, has built their entire business model around combining energy generation with carbon capture, demonstrating clear market demand for integrated approaches.

Execution Excellence: Our Path to Market Leadership

Here’s where vision meets execution. Our 2025/2026 road-map isn’t just ambitious—it’s strategically designed to capture maximum value at each stage:

Phase 1: Proof of Concept (2025-2027)

– Complete prototype demonstrating both fusion and dequestration capabilities.

– Validate materials and plasma physics through strategic research partnerships.

– Secure strategic partnerships with industrial off-takers.

– Build patent portfolio around our proprietary integration technology

Phase 2: Commercial Validation (2027-2030)

– Pilot plant demonstrating grid integration and full dequestration cycle

– Establish regulatory pathways for commercial deployment

– Scale manufacturing capabilities for key components

– Secure long-term power purchase agreements

**Phase 3: Market Domination (~2030+)**

– Roll out commercial-scale installations globally

– Capture premium pricing through dual value streams

– License technology to strategic partners

– Establish Cydonis as the category-defining platform

This isn’t just a research project—it’s a commercialisation pathway with clear value inflection points and multiple exit strategies.

The Investment Opportunity: Strategic Capital for Strategic Returns

We’re seeking partners who understand that the biggest returns come from backing category-creating technologies before they become obvious to everyone else.

Your Investment Powers:

– 50% R&D Acceleration: Fast-track both fusion and dequestration technology development.

– 25% Manufacturing Scale-Up: Build competitive moats through advanced manufacturing capabilities.

– 15% Strategic Market Capture: Secure partnerships with industrial leaders and energy utilities.

– 10% World-Class Team Building: Attract the industry’s top talent across fusion physics, materials science, and carbon chemistry.

What This Delivers:

– First-mover advantage in the fusion-plus category

– Multiple revenue streams reducing technology risk

– Strategic partnerships validating market demand

– Clear pathway to premium valuation at each funding stage

➡🌌✨ De-Risking Through Diversification

One of the most compelling aspects of our dual technology approach is how it mitigates typical deep tech risks. Even if energy generation faces unexpected challenges, our carbon management capabilities provide alternative revenue streams and market entry points. This diversification makes our investment more resilient than single-solution approaches.

The recent challenges faced by some fusion companies, including General Fusion’s workforce reductions due to funding difficulties, underscore the importance of having multiple value propositions. Our dequestration technology could provide earlier commercialization pathways and more immediate returns Whilst the fusion component reaches full commercial scale.

The Generational Opportunity

The green energy transition will create more wealth than the internet revolution—and we’re still in the early stages. At Cydonis Heavy Industries, we’re not just participating in this transformation; we’re defining what the next chapter looks like.

Our fusion-dequestration platform/tech stack represents what every institutional investor is seeking: a technology that’s defensible, scalable, and addresses markets large enough to generate category-defining returns. We’re not promising overnight success—we’re delivering systematic execution toward market leadership in the most important & vital sector of the 21st century.

The question isn’t whether the world will need solutions that provide both clean energy and carbon management. The question is who will own the platforms that deliver them, and the continued survival of the human race into the 22nd century.

Exclusive Access to the Future

This isn’t a public offering. Cydonis will always remain a private company, not publicly traded. We’re not for sale, and neither is our morality & deep rooted sense of community-led ethical operations at any stage. We value humanity & human wellbeing over profit. We’re selectively partnering with institutional investors who understand deep technology and have the patient capital to back category-defining world-first innovations.

If you’re seeking exposure to the next generation of energy infrastructure—where clean power generation and carbon management converge into a single, highly valuable platform—this represents a rare opportunity to participate at the ground floor.

The fusion-dequestration revolution is coming. The only question remaining is this: whether you’ll be invested in it or competing against it.

*Ready to explore how Cydonis Heavy Industries can deliver strategic value to your portfolio? Contact our investor relations department for access to our detailed 2025/2026 prospectus, evaluator privileges, and confidential technology demonstrations.